Financial Innovation

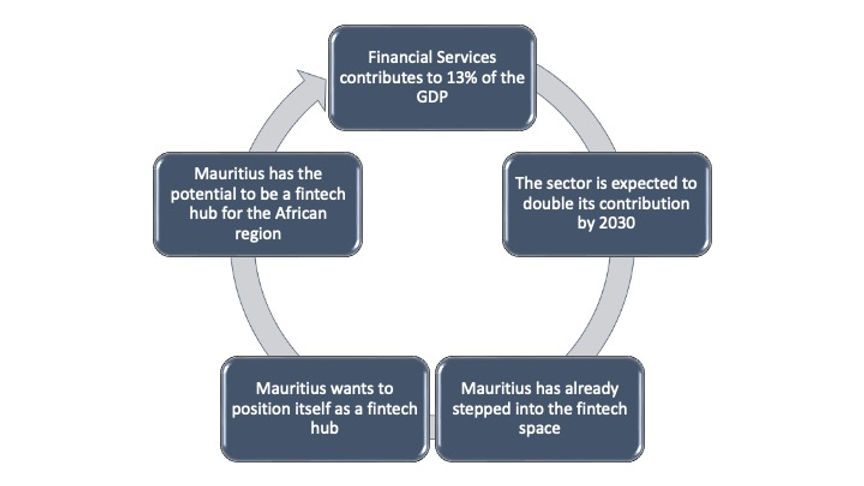

Financial Innovation was one of the thematic areas identified. Financial Innovation is the act of creating new financial instruments as well as new financial technologies, institutions and markets. The Financial Services Sector represents an important pillar of our economy. Financial innovation has come via advances in financial instruments, technology and payment systems.

.jpg)

A technical committee consisting of different stakeholders in the financial sector was brought together and consisted of the following members:

-

Mr Vinod Bussawah, Mauritius Finance

-

Mr Geetesh Gungah, Economic Development Board

-

Mr Rajnish Hawabhay, Ministry of Information and Communication Technology

-

Mr Jamsheed Khadaroo, Financial Services Commission

-

Mr Kailass Koonjal, Independent Commission Against Corruption

-

Mr Ashwin Jankee, Mauritius Bankers Association Ltd

-

Ms Tilotma Gobin Jhurry, Bank of Mauritius

-

Dr Bhavish Jugurnath, University of Mauritius

-

Mrs Varsha Mooneeram–Chadee, University of Mauritius

-

Mr Avinash Nemchand, Financial Services Commission

-

Mr Roshan Oree, Mauritius Revenue Authority

-

Mrs Dovinassy Pillay-Naiken, Ministry of Financial Services and Good Governance

-

Mr Faraz Rojid, Economic Development Board

The panel discussion was held during Les Assises on 28th April 2022 and was made up of:

-

Ms Nousrath Bhugeloo, Nexus Global Financial Services Ltd

-

Mr Vinod Bussawah, Mauritius Finance

-

Mr Rajnish Hawabhay, Ministry of Information Technology, Communication and Innovation

-

Ms Tilotma Jhurry, Bank of Mauritius

-

Dr Bhavish Jugurnath, University of Mauritius

-

Mr Naushad Khadun, Financial Services Institute

-

Mr Jamsheed Ali Khadaroo, Financial Services Commission

-

Mr Michal Szymanski, Mauritius Africa Fintech Hub

Poll questions were asked during the presentation which included the following:

The following recommendations came out of the working group sessions and the panel discussion:

-

Have a national concerted approach

-

Need to communicate extensively on existing products, i.e. Open Banking/MoKloud/Maupass

-

Financial literacy and Financial Inclusion

-

Setting up of a Financial Innovation Fund and find alternate means of funding

-

Create schemes for start-ups to access funding

-

Training and skills in digital finance – Review the courses to reduce cost of compliance

-

Creation of digital ID for legal and natural persons

-

Digitalisation of KYC documents and digital KYC process for onboarding of clients

-

Technology should be mapped with strong legal framework. i.e. Cybersecurity to give trust

-

Risk Assessment and Digital Governance literacy

-

Set up a sovereign fund which can be used to foster fintech for the African Region

-

Set up an Africa Regulatory Sandbox in Mauritius to attract start-ups.

By: Dr N Gopaul, Ms H Keenoo,

Ms K Lakheearam